Canadian Financial Services Consumer Protection

Canadian financial services consumers can feel secure in knowing that Canada has a strong well-regulated financial services sector, and that in the unlikely event that a Canadian financial institution fails, consumers are protected by a variety of compensation plans.

If you have a bank account, you may be familiar with Canada Deposit Insurance Corporation (CDIC) that provides protection to Canadian account holders. The Canada Deposit Insurance Corporation is a Canadian federal Crown Corporation created by Parliament in 1967 to provide deposit insurance to depositors in Canadian commercial banks and savings institutions. CDIC insures Canadians' deposits held at Canadian banks up to $100,000 in case of a bank failure.

Assuris protects Canadian insurance policyholders

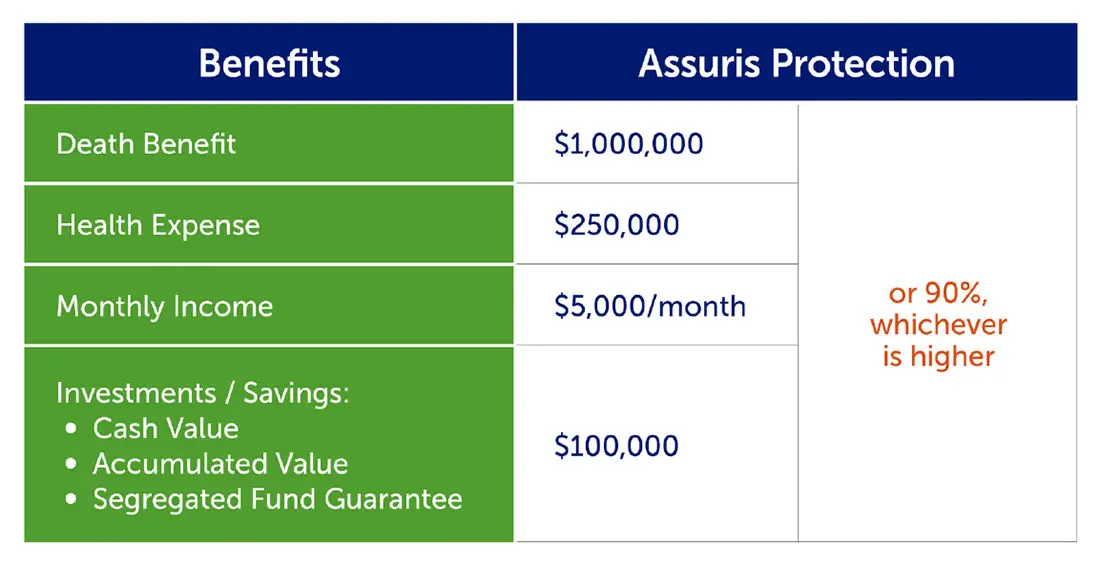

If you have life or health insurance, you can have peace of mind that the Office of the Superintendent of Financial Institutions, an independent agency of the Government of Canada reporting to the Minister of Finance governs the insurance industry with stringent regulations. Further, every insurance company authorized to sell life and health insurance policies in Canada is required, by the federal, provincial, and territorial regulators, to be a member of Assuris. Founded in 1990, Assuris is the independent not-for-profit organization that protects Canadian policyholders of life and health insurance products. Backed by the strength of the life and health insurance industry, Assuris provides a safety net for every Canadian policyholder. The maximum protection provided by Assuris is up to the amounts shown below, depending on your coverage amount:

To learn more about Assuris, read the Assuris brochure, and to learn more about all of the compensation plans that safeguard the financial well-being of Canadians, you can visit www.financeprotection.ca or contact our office.